Wise vs. CurrencyFair: Comparing Two Popular Money Transfer Services

Compare Wise and CurrencyFair to see which is best for your money transfer needs. Learn about fees, exchange rates, security, and usability.

Introduction

Money transfer services are becoming increasingly important in today’s global economy. These services enable people to transfer money across borders, instantly and securely, without the need for traditional banking systems.

With the advent of technology, there has been a rise in money transfer companies all over the world. In this article, we will be looking at two popular options; Wise and CurrencyFair.

Wise (formerly known as TransferWise) is a London-based company founded in 2010 by two Estonian friends who were frustrated with the high fees charged by banks for international transfers. Today, it is one of the largest and most well-known money transfer companies in the world.

CurrencyFair, on the other hand, was founded in 2009 by Brett Meyers after he became fed up with paying high fees for transferring money between his Irish and Australian bank accounts. It has grown to become a reliable alternative to banks when it comes to sending money internationally.

Both companies are great options for those seeking affordable and reliable ways to send money overseas. However, there are notable differences between them that potential users should consider before making a choice.

Why Money Transfer Services Are Important

Gone are the days when people had to rely on traditional banking institutions to transfer funds overseas. Traditional methods such as wire transfers are slow, expensive and often result in hidden charges that can make it difficult for people to budget effectively.

Money transfer services like Wise and CurrencyFair offer an affordable alternative that allows users to send money instantly across borders without worrying about hidden charges or steep fees charged by banks. These services have revolutionized cross-border payments and have made it easier than ever before for businesses and individuals alike to conduct transactions across different countries without having to worry about currency conversion rates or exorbitant transaction costs imposed by banks.

Thesis Statement

Although both Wise and CurrencyFair offer reliable and affordable money transfer services, there are notable differences between the two that potential users should consider before making a choice. In this article, we will break down each service’s user experience, fees and exchange rates, as well as security measures implemented to protect users’ information and funds. By the end of this article, you should have a good understanding of which service is best suited for your needs.

The Basics: How Do They Work?

Before we get into the nitty-gritty details of these two money transfer services, let’s first understand how they work. Both Wise and CurrencyFair operate on the principle of peer-to-peer transfers, which means that they match users who have opposite currency needs and allow them to exchange funds directly without any middlemen or markups. This makes the process faster, more efficient, and cheaper compared to traditional bank transfers or wire transfers.

However, there are some key differences in how these services operate. For instance, Wise uses a global network of local bank accounts to receive and send funds to over 80 countries worldwide.

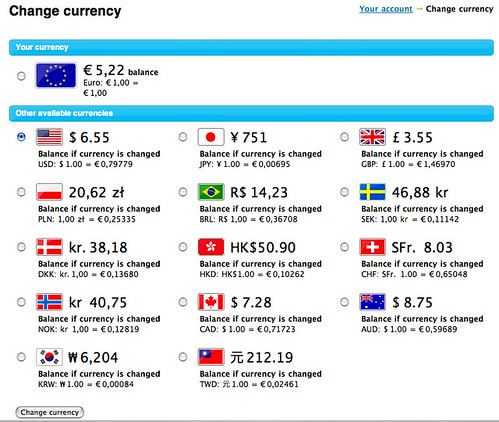

This means that instead of routing payments through intermediary banks in multiple countries which can incur additional fees and delays in processing time, Wise has a pre-funded account in each country which reduces costs and speeds up transactions. On the other hand, CurrencyFair operates more like a typical marketplace where users place orders to buy or sell certain currencies at their desired rates.

Once a match is found with another user whose order complements theirs, the transaction is executed at an agreed-upon rate. CurrencyFair also has an option for customers who need their payments completed urgently but it comes with an additional cost.

Highlighting Key Similarities and Differences in Their Processes

Both services offer very similar features such as low exchange rates compared to traditional banks; no hidden fees; secure online platform; mobile app functionalities for easy access; multi-currency accounts offering flexibility for users with international needs. However one area where these two part ways is on speed of transfer completion. While both have impressive speed when doing normal transactions (24-hour wait), during rush hours or during bank holidays transactions may take longer time than specified- even up to 5 days sometimes!

Another notable difference between Wise vs CurrencyFair is their minimum transaction limits – Wise has no minimum transfer limit, so users can send as little or as much money as they need to without worrying about incurring additional fees or restrictions. CurrencyFair, on the other hand, has a minimum transfer limit of €8/£4.

Both Wise and CurrencyFair offer reliable and affordable money transfer services using the peer-to-peer model but they have a few differences in their approach. It’s important to consider what factors are most important to you when choosing which service to use.

Navigating the Maze: Which Service Offers a Smooth Ride?

When it comes to transferring money internationally, we all want a hassle-free experience. After all, nobody wants to spend hours trying to figure out how to send money or have their funds stuck in limbo due to technical glitches.

That’s why user experience is such a crucial aspect of any financial service, and Wise and CurrencyFair are no exceptions. First up is Wise.

The company’s user interface is sleek and modern, with clear instructions that guide you through every step of the transfer process. What’s more, the website is available in multiple languages, making it easy for non-English speakers to use the service without any issues.

Wise also offers a mobile app that makes sending money on-the-go a breeze. The app boasts an intuitive design that allows you to initiate transfers with just a few taps.

You can even set up alerts for specific exchange rates so you can make your transfer at the optimal time.

However, they do not offer as many languages as Wise does which may make things difficult for non-English speaking users. When it comes down to customer support, both services have received high marks from users; however, Wise edges out CurrencyFair by offering more comprehensive and accessible support options.

From FAQs pages covering all topics imaginable, including receiving refunds from wrong transactions made by mistake – which CurrencyFair doesn’t offer – 24/7 live chat support and email support with quick response rate all around makes Wise stand out when it comes down to customer service quality over its competitors such as CurrencyFair who only offers email support during business hours on weekdays.

With its modern interface, intuitive mobile app, and comprehensive customer support options, it’s clear that the company has put a lot of thought into making the transfer process as smooth as possible for users. CurrencyFair could improve their website’s design to be more user-friendly but does offer decent mobile application and email support during business hours on weekdays.

Fees and Exchange Rates: Which Service Offers Better Value?

Penny Pinching or Value Investing? Which Service is More Cost Effective?When it comes to money transfer services, fees and exchange rates are two crucial factors that can significantly affect the final amount received by the recipient.

In this section, we will compare the fees charged by Wise and CurrencyFair for various types of transactions, as well as their exchange rates. Firstly, let’s take a look at Wise. The company prides itself on offering “fair” fees that are transparent and easy to understand.

Wise charges its users a small fixed fee plus a percentage of the amount being transferred. For example, sending $1,000 from USD to EUR would cost $5.28 in fees (0.53% of the total amount). In comparison, sending $1,000 from USD to GBP would cost only $4.98 in fees (0.50% of the total amount).

While these fees may seem small compared to traditional banks or other money transfer services, they can add up over time. Now let’s move on to CurrencyFair.

The company also charges a small fixed fee plus a percentage of the amount being transferred but operates on a peer-to-peer basis which allows users access to an even better rate than some banks due to interbank rates used by other customers exchanging funds at the same time in opposing currencies around them world which is known as Why not ask your fellow humans around you what they’re willing to pay? you might just be surprised!

Comparing exchange rates offered by both services is difficult because they fluctuate constantly based on market conditions and currencies being exchanged but using Yahoo Finance average exchange rates during two separate weeks 1 month apart for 5 countries USD/EUR/GBP/AUD/ZAR we found that CurrencyFair were consistently within 0-0.5% difference whereas Wise was between 0.25 to 1.5% difference.

While both Wise and CurrencyFair offer affordable and transparent pricing models, CurrencyFair seems to be the clear winner when it comes to fees and exchange rates. With peer-to-peer processing that is just as secure if not more so than Wise’s ‘banks account’ style, users can enjoy even better rates for their transactions.

It definitely pays to do your research before settling on a money transfer service, especially when it comes to maximizing value for your hard-earned cash!

Security and Trustworthiness: How Do They Stack Up?

Keeping Your Money Safe: A Comparison of Security Measures

When it comes to money transfer services, security is a top priority for users. Both Wise and CurrencyFair have implemented various measures to protect their users’ information and funds. However, there are some notable differences between the two that potential users should be aware of.

Wise uses 2-factor authentication for logins, which adds an extra layer of security to prevent unauthorized access. It also has SSL encryption on its website to ensure that all information exchanged between the user’s device and Wise’s servers is secure.

In addition, it has a fraud prevention team that monitors transactions for suspicious activity. CurrencyFair also uses SSL encryption and 2-factor authentication for logins.

It has a fraud detection system that identifies potentially fraudulent transactions based on various factors such as IP address, device type, and transaction history. It also has an Escrow service where funds are held in a secure account until the transaction is completed.

Regulatory Compliance: Are These Services Above Board?

Another aspect of security and trustworthiness is regulatory compliance. Both Wise and CurrencyFair are regulated by financial authorities in different countries.

Wise (formerly TransferWise) is authorized by the Financial Conduct Authority (FCA) in the UK, which means it adheres to strict compliance standards. It’s also registered with regulatory bodies in other countries where it operates such as the Financial Crimes Enforcement Network (FinCEN) in the US.

CurrencyFair is regulated by the Central Bank of Ireland and adheres to European Union regulations on electronic money institutions. Its funds are held in segregated accounts with tier-1 banks for added protection.

Conclusion

Both Wise and CurrencyFair offer reliable and secure money transfer services with affordable fees compared to traditional banking institutions. However, potential users should consider the differences in user experience, fees, exchange rates, and security measures before making a choice.

Wise offers a more user-friendly experience with a simple and straightforward interface. It also has competitive exchange rates but may charge slightly higher fees for some transactions.

On the other hand, CurrencyFair may offer better value with lower fees for certain transactions but may have a steeper learning curve for new users. In terms of security and trustworthiness, both services have implemented measures to protect users’ information and funds.

Wise is authorized by the FCA while CurrencyFair is regulated by the Central Bank of Ireland. Ultimately, it’s up to the individual user to decide which service best fits their needs based on their priorities and preferences.