What is the Best Way to Send Money from US to Canada?

Introducing Remitly as a SolutionSending money from one country to another can be a challenging and daunting task, especially when it comes to finding a reliable and cost-effective service. This is particularly true for those who need to send money from the US to Canada, where traditional methods like bank wires or checks can be slow and expensive.

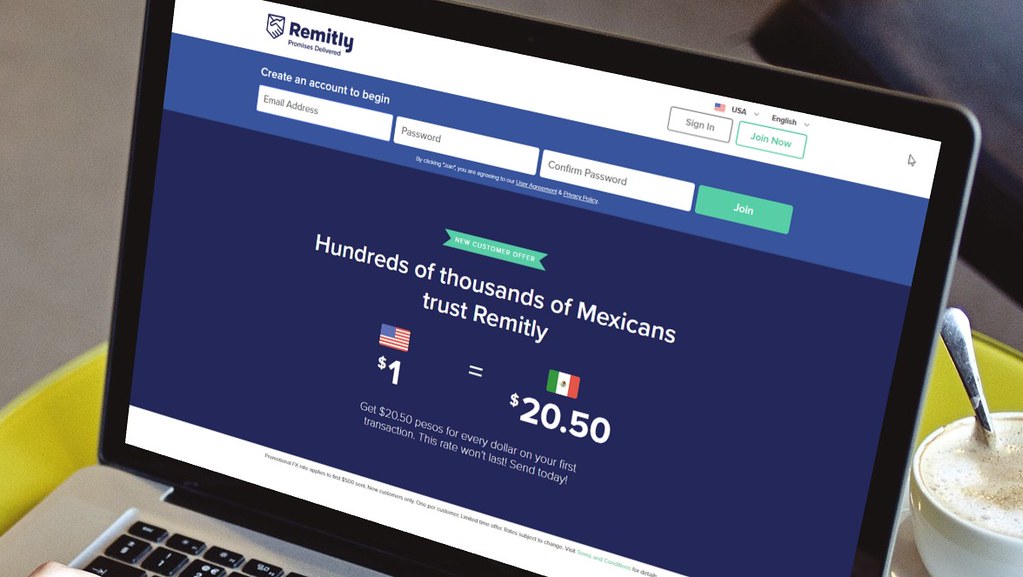

That’s why it’s important to explore alternative options that offer faster transfer times and lower fees. One of these options is Remitly. Remitly is an online platform that provides an easy and secure way for people in the US to send money to their friends or family members in Canada.

It was founded in 2011 with the goal of making international money transfers more accessible, affordable, and convenient for everyone. Unlike traditional methods of sending money overseas, Remitly offers competitive exchange rates, transparent fees, and multiple payment options that cater to different needs and preferences.

With over 2 million customers around the world, Remitly has earned a reputation for being a trustworthy and reliable service provider that values customer satisfaction above all else.

Whether you’re sending money for personal reasons such as supporting your family back home or business-related purposes such as paying suppliers or contractors in Canada, Remitly offers a range of features that make the process seamless and hassle-free. In the next sections of this article, we’ll delve deeper into how Remitly works and why it’s worth considering as your go-to option for sending money from US to Canada.

Understanding the Process

Sending money from the United States to Canada may seem like a simple task, but there are several factors to consider. The most important thing to understand is that currency exchange is involved.

This means your US dollars will need to be converted into Canadian dollars before they can be received by the recipient. The exchange rate fluctuates daily, which will affect how much money the recipient receives in Canadian dollars.

Traditionally, people have used banks or remittance services to transfer money from one country to another. However, these methods are often slow and come with high fees and unfavorable exchange rates.

Online platforms like Remitly provide a faster and more affordable alternative.

Comparison of traditional methods vs. online platforms like RemitlyBanks typically charge high fees for international transfers and offer less favorable exchange rates compared to online platforms like Remitly. Additionally, bank transfers can take several days or even weeks for the recipient to receive the funds.

Remittance services have been around for years as an alternative option but still came with higher fees than traditional banks. With online remittance companies such as Remitly, customers benefit from faster transfer times – sometimes even within minutes – as well as lower transaction fees and more favorable exchange rates compared with banks or other remittance companies. Online platforms like Remitly also offer greater convenience with user-friendly interfaces on both desktop and mobile devices, easy sign-up processes with minimal documents needed for verification purposes, and great customer service options including phone support and live chat features available 24/7.

Advantages of Using Remitly

Faster Transfer Times and Lower Fees Compared to Traditional Methods

One of the biggest advantages of using Remitly for sending money from the US to Canada is its speed. Unlike traditional methods, which can take several business days for funds to arrive, Remitly offers express delivery options that can transfer money within minutes.

This makes it a great choice for urgent transfers or last-minute payments. In addition, Remitly also offers some of the lowest fees in the market.

While traditional money transfer methods like wire transfers or cash pickups can charge exorbitant fees, Remitly charges a flat fee based on the transfer amount and currency exchange rate. This means that users know exactly how much they will be charged upfront and can avoid hidden fees or unexpected charges.

User-Friendly Interface and Mobile App for Convenience

Remitly’s user-friendly interface is another advantage that sets it apart from traditional methods. The platform is designed to be intuitive and easy-to-use, even for those who may not have much experience with online payment systems. The mobile app is another convenient feature that allows users to send money on-the-go from their smartphones or tablets.

The app offers all the same features as the desktop version, including real-time tracking of transfers and push notifications when funds are received. Whether using a desktop computer or mobile device, Remitly’s interface is straightforward and user-friendly, making it an ideal solution for individuals who may not be tech-savvy but still need to send money across borders.

Secure Encryption and Fraud Protection Measures

Sending money online can be risky due to concerns about fraud or theft. However, Remitly takes security seriously by offering state-of-the-art encryption technology to protect user information and prevent unauthorized access. Remitly also employs fraud protection measures such as two-factor authentication and identity verification to ensure that users are who they say they are.

This added security can provide peace of mind for individuals who may be hesitant about sending money online. Overall, Remitly’s combination of speed, affordability, convenience, and security make it an excellent solution for anyone looking to send money from the US to Canada.

How to Use Remitly

Step-by-step guide on how to sign up, verify identity, and send money through the platform

Signing up for Remitly is a simple process that takes only a few minutes. Visit the website and select your destination country (Canada) and preferred payment method (bank transfer or debit/credit card). Then, enter your personal information such as name, address, and contact details.

Once this is done, you will receive an email with a link to verify your identity by providing some additional documentation such as a valid government-issued ID. This is an important step that ensures your account is secure and compliant with international regulations.

After verifying your identity, you are ready to start sending money! Simply enter the recipient’s details such as their name and address, along with the amount of money you wish to send.

You can also choose from different delivery options such as home delivery or deposit into their bank account. Review all the details carefully before submitting the transfer request.

Overview of available payment options (bank transfer, debit/credit card)

Remitly offers multiple payment options for added convenience when transferring funds from US to Canada. You can choose between bank transfers or debit/credit cards depending on what works best for you.

Bank transfers are typically free but may take a few days to process while credit/debit card payments are processed faster but may come with additional fees. When using bank transfers, ensure that you have all necessary banking information including routing numbers which can be found on checks or online banking portals.

With debit/credit cards payments, ensure that you have sufficient funds in your account and be aware of possible transaction fees charged by both Remitly or your bank. Signing up for Remitly is easy and straightforward requiring only basic personal information verified by a valid ID document before being able to transfer funds using multiple payment options.

Tips for a Smooth Transaction

Best Practices for Ensuring a Successful Transfer

When it comes to sending money from the US to Canada, there are several best practices you should follow to ensure your transfer is successful. First and foremost, double-check the recipient’s information before submitting the transfer. Make sure you have the correct name, address, and bank account information to avoid any delays or errors.

Additionally, consider sending money outside of peak hours. While many online platforms like Remitly offer 24/7 service, transfers may take longer during peak times due to high volume.

By sending money during off-peak hours, you increase the likelihood of a faster transfer time. Another tip for ensuring a successful transfer is to plan ahead.

Give yourself enough time for your funds to arrive at their destination so you can avoid any last-minute stress or panic if there are delays. Make sure you have sufficient funds in your account before initiating the transfer – this can help prevent any issues that may arise during processing.

Common Mistakes to Avoid

There are also some common mistakes that people make when sending money from the US to Canada. One mistake is not properly verifying their identity with the platform they’re using (like Remitly). To avoid this error, make sure you’ve submitted all necessary documents and have completed any required verification steps before attempting a transfer.

Another mistake people make is failing to understand the fees associated with their chosen method of payment. For example, if you choose to use a credit card for your transfer through Remitly or another platform, there may be additional fees beyond what’s advertised on their website.

Be sure to read all terms and conditions carefully and ask customer support if you have any questions or concerns. One major mistake people often make when transferring money between countries is forgetting about exchange rates.

Make sure you understand the current rate between the US and Canada before initiating your transfer, so you can get a better idea of how much money will actually arrive at the recipient’s bank account. With these tips in mind, you can make sure your transfer goes smoothly and avoid any unnecessary headaches or delays.

Customer Support

When it comes to sending money, customer support can make all the difference. Fortunately, Remitly offers a range of support channels to help users with any questions or issues they may encounter. One option is email support, which allows users to submit a ticket and receive a response from the Remitly team within 24 hours.

This is a great option for non-urgent issues or questions that require more detail. For those who need more immediate assistance, the platform also offers phone and chat support.

Phone support is available during business hours and allows users to speak directly with a member of the Remitly team. Chat support, on the other hand, is available 24/7 and provides quick responses to basic questions or issues.

Overview of Available Support Channels

Remitly’s customer support team is known for being knowledgeable, friendly, and efficient. They are happy to answer any questions about the platform’s features or assist with troubleshooting during transactions. Additionally, the company’s website has a comprehensive FAQ section that covers common questions about sending and receiving money through Remitly.

Examples of Positive Customer Experiences with Remitly

Numerous customers have shared positive experiences with Remitly’s customer service team online. Many praise them for their fast response times and helpfulness in resolving issues quickly. One user stated that they had an issue verifying their account but were able to reach out to customer service via chat and received assistance within minutes.

Another user praised Remitly for its ease of use as well as its responsive customer service team: “I’ve used other platforms in the past but found myself frustrated by complicated processes or slow response times from customer service reps,” they said. “With Remitly, I’ve never had an issue sending money abroad.”

Conclusion

Overall, Remitly proves to be a highly recommended option for sending money from the US to Canada. With its fast transfer times and lower fees compared to traditional methods, Remitly is a great solution for those who need to send money quickly and securely.

The user-friendly interface and mobile app make it easy to navigate the platform and send money on-the-go. Plus, with secure encryption and fraud protection measures in place, users can feel confident that their money is being transferred safely.

When using Remitly, it’s important to follow best practices for ensuring a smooth transaction. Double-checking recipient information and avoiding peak hours can help prevent any issues or delays.

And if there are any questions or concerns, customer support is available through email, phone, and chat. Remitly offers an efficient and reliable way to send money from the US to Canada.

With its many advantages over traditional methods of transferring funds, it’s clear why so many people have turned to this online platform. So next time you need to send money across borders, consider using Remitly for a hassle-free experience!