Send Money from UK to US Using Currencyfair in 2023

Learn how to send money from UK to US using CurrencyFair in 2023. Discover the benefits of low fees, competitive exchange rates, and fast processing time.

Why Sending Money Internationally is Becoming More Important

Sending money internationally has become increasingly common in recent years, thanks to globalization and the rise of remote working. People are now able to work for companies located anywhere in the world, from the comfort of their own homes. This means that individuals are often required to send and receive money from other countries.

Additionally, international travel has become more affordable and accessible than ever before, making it easier for people to move from country to country. Despite the increasing need for international money transfers, traditional banks have been slow to adapt.

They often charge high fees and offer unfavorable exchange rates. This has led many people to look for alternative methods of sending money across borders.

Introducing CurrencyFair: A Reliable Platform for Sending Money from Pounds to dollars

CurrencyFair is a peer-to-peer currency exchange platform that offers a fast, secure, and cost-effective way of transferring money internationally. It allows users to trade currencies with others around the world at a rate that they both agree upon. The platform’s innovative technology matches buyers with sellers who are looking for the opposite currency.

CurrencyFair was founded in 2010 by a group of expats who were frustrated with traditional banks’ high fees and poor exchange rates when sending money abroad. Today, it has grown into one of the most trusted and popular platforms for international money transfers.

If you’re looking for a reliable way to send money from pounds to dollars without paying exorbitant fees or getting ripped off by unfavorable exchange rates, CurrencyFair may be just what you need. In this article, we’ll take a closer look at how CurrencyFair works and why it’s an excellent choice for sending money internationally in 2023!

Understanding CurrencyFair

How CurrencyFair Works

CurrencyFair is an online platform that allows people to send and receive money from anywhere in the world. The service operates by matching individuals who want to exchange different currencies. For example, if someone in the UK wants to send money to someone in the US, CurrencyFair will match them with someone who wants to exchange US dollars for British pounds.

This ensures that the exchange rates are fair and transparent, as both parties are able to negotiate a rate that works for them. The process of using CurrencyFair is simple and straightforward.

Users create an account and then deposit money into their account using their preferred payment method, which can be a bank transfer or debit/credit card. Once the funds are deposited, users can then initiate a transfer by choosing the currency they want to exchange and entering the amount they wish to send.

The Benefits of Using CurrencyFair

CurrencyFair offers several benefits over traditional banks and other transfer services. First and foremost, it allows users to access competitive exchange rates that are often lower than those offered by banks or other providers.

This means that users get more value for their money when sending funds overseas. In addition, because CurrencyFair operates on a peer-to-peer model, there are fewer fees associated with using the service compared with traditional banks or other providers.

For example, there are no hidden fees or markups on exchange rates – what you see is what you get. CurrencyFair offers fast processing times – typically between 1-2 business days – which means that users can access their funds quickly when they need them.

Comparison with Traditional Banks and Other Transfer Services

Compared with traditional banks and other transfer services such as Western Union or MoneyGram, CurrencyFair offers several advantages. For one thing, it tends to offer better exchange rates than banks or other providers. This is because the platform operates on a peer-to-peer model, which means that users can negotiate exchange rates directly with each other.

In addition, CurrencyFair tends to have lower fees than traditional banks and other transfer services. This is because it doesn’t have the same overhead costs associated with running brick-and-mortar branches or maintaining large staffs.

CurrencyFair offers fast processing times compared with traditional banks. While some banks can take several days to process an international transfer, CurrencyFair typically processes transfers within 1-2 business days.

Sending Money from UK to US using CurrencyFair in 2023

A Step-by-Step Guide on How to Send Money through CurrencyFair in 2023

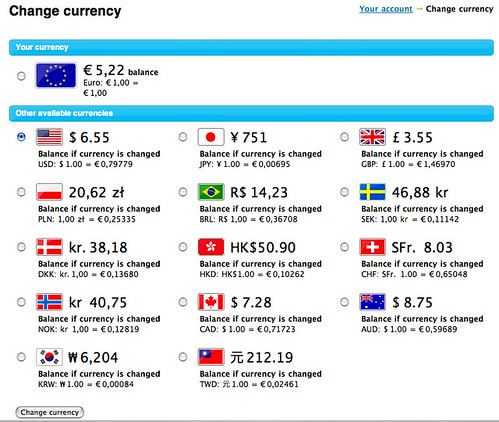

CurrencyFair offers a user-friendly platform for transferring money globally. The first step is to create an account on their website, which only takes a few minutes. Once you’ve registered, log into your account and select “New Transfer” from the dashboard. Next, enter the amount of money you want to send and select GBP as your currency. On the following screen, choose USD as the recipient’s currency.

The platform will automatically calculate how much money you’ll receive based on the current exchange rate and fees. Then, enter your recipient’s details – their name, bank details (including routing number), and address.

You can also add a reference note if needed. Review all information before clicking “Confirm” to initiate the transfer process.

Details on Exchange Rates, Fees, and Processing Time

CurrencyFair offers some of the most competitive exchange rates in the market for sending money from UK to US in 2023. The exchange rate is updated every few seconds according to current market conditions so that you receive an accurate rate at all times.

In terms of fees, CurrencyFair charges a flat fee of £2 or its equivalent in other currencies per transaction plus an additional fee that varies based on factors such as location and transfer amount. However, these fees are still lower than those charged by traditional banks or other transfer services.

Processing time depends on how quickly your recipient’s bank processes incoming transfers; however, transfers typically arrive within one business day or less after being sent from CurrencyFair. Overall, sending money through CurrencyFair is straightforward with competitive rates and low fees compared to traditional banks or other transfer services.

Benefits of Using CurrencyFair for International Money Transfers

Low fees compared to traditional banks

When it comes to sending money overseas, one of the biggest concerns is often the fees involved. Traditional banks can charge high transaction and exchange rate fees, which can add up quickly, especially for large sums of money. CurrencyFair, on the other hand, offers some of the lowest fees in the industry.

In fact, depending on where you’re sending money from and to, you may even be able to save up to 90% compared to traditional bank transfer fees. That means more money in your pocket or more money for your recipient.

Competitive exchange rates

Exchange rates are another important factor when it comes to international money transfers. The exchange rate determines how much currency you will receive when converting your funds from one currency to another.

CurrencyFair offers highly competitive exchange rates that are often better than what you’ll find at a traditional bank. This means that you’ll get more bang for your buck and your recipient will receive more funds as well.

Fast processing time

Whether you’re sending money for an emergency or just want a quick transfer, processing time is crucial. With CurrencyFair’s innovative platform, transfers typically take just 1-2 business days from start to finish. This means that funds can be sent and received quickly without any unnecessary delays or complications.

Secure transactions

Last but not least, security is always a top priority when it comes to finances and international transfers are no exception. Thankfully, CurrencyFair has implemented several measures to ensure that all transactions are secure and protected against fraud or hacking attempts. The platform uses SSL encryption technology as well as two-factor authentication for added security measures.

If you’re looking for a fast, reliable way to send money internationally while also saving money on fees and getting competitive exchange rates, then CurrencyFair is definitely worth considering. With their low fees, fast processing time, and secure transactions, you can rest assured that your funds are in good hands.

Tips for a Smooth Transaction

How to avoid common mistakes when sending money internationally

Sending money internationally can be a daunting task, especially if it’s your first time. The process involves multiple steps, including dealing with exchange rates, fees, and processing times. However, you can avoid common mistakes if you follow some best practices.

First and foremost, make sure that you have all the necessary information regarding the recipient’s bank account details and personal information. Sending money to the wrong account or person is one of the most common mistakes that people make while sending international transfers.

Another mistake to avoid is not researching the transfer company before making a transaction. It’s crucial to choose a reputable and reliable service provider like CurrencyFair to ensure your money is safe and secure during transfer.

Best practices for ensuring a successful transfer

To ensure that your international transfer goes smoothly, there are some best practices that you should follow. One of these practices is to double-check all the required details before initiating the transfer process.

This includes checking for any typos in recipient’s name or bank account number. Next, it’s important to keep track of your transaction status until it reaches its destination successfully.

CurrencyFair provides regular updates on your transaction via email notifications or on their website dashboard. Consider timing your transfers according to exchange rate fluctuations in order to maximize the amount of money being transferred.

This could mean waiting until certain times during the day or week when exchange rates are more favorable. Following these tips will not only help you avoid common mistakes but also increase your chances of having a successful transfer experience with CurrencyFair.

Conclusion

Overall, sending money from UK to US using CurrencyFair in 2023 is a reliable and cost-effective option. With low fees compared to traditional banks, competitive exchange rates, and fast processing time, CurrencyFair stands out as a top choice for international money transfers. Additionally, CurrencyFair’s secure transactions ensure that your money is protected throughout the transfer process.

You can rest assured that your funds will reach their intended destination without any issues. CurrencyFair is a trusted platform for sending money internationally from UK to US in 2023.

Its user-friendly interface and transparent pricing make it easy to use for individuals and businesses alike. So if you need to send money overseas, consider using CurrencyFair as your go-to transfer service.