Money-Saving Magic: Why CurrencyFair Is The Best Option For International Transfersving

Discover how CurrencyFair’s low fees, competitive rates, fast transfers, secure transactions, and user-friendly platform make it the best choice for overseas transfers.

Introduction: The Need for Overseas Transfers

Traveling and living abroad has become a common occurrence in today’s globalized world. With the rise of remote work, international education, and global trade, people are increasingly finding themselves needing to send money overseas. Whether you’re paying for tuition fees at a foreign university or sending money to family members in another country, making overseas transfers has become an essential need.

But how does one go about making these transactions securely and cost-effectively? Enter CurrencyFair, an online peer-to-peer marketplace that allows users to transfer money internationally with ease.

A Brief Overview of CurrencyFair

CurrencyFair was founded in 2009 by a group of expats who were frustrated with the high fees and poor exchange rates offered by traditional banks when transferring money abroad. The platform connects individuals looking to exchange currencies at competitive rates with others who are doing the same in opposite directions. This system allows CurrencyFair to offer lower fees than traditional banks while ensuring speedy transactions.

The Importance of Making Overseas Transfers

Making overseas transfers is more important than ever before due to the increasing globalization of our world. Whether it’s purchasing goods from foreign websites or sending money to family members living abroad, international transfers have become a necessary part of our lives. Moreover, using traditional banks for international transfers can be expensive due to high transfer fees and unfavorable exchange rates.

These costs can add up quickly and eat away at your hard-earned dollars. What’s worse is that it can take several days or even weeks for your funds to arrive at their destination, leaving you feeling frustrated and powerless.

In this article, we’ll dive into why CurrencyFair pays off when it comes to making overseas transfers. From low fees and competitive exchange rates to fast transfers and secure transactions, we’ll explore all the reasons why CurrencyFair should be your go-to platform for international money transfers.

Low Fees

The Savings You Can Expect with CurrencyFair

Let’s face it, banks have been getting away with charging exorbitant fees for international money transfers for far too long. Fortunately, companies like CurrencyFair have emerged to challenge this status quo by offering significantly lower fees to users.

Compared to traditional banks that can charge up to 5% of the transfer amount in fees, CurrencyFair offers a much more affordable rate of just 0.25-0.45%. This may not seem like a huge difference, but it can add up quickly when you’re transferring large sums of money.

For example, if you were transferring $10,000 overseas, a bank might charge you $500 in fees. With CurrencyFair’s fee of just 0.45%, you would only pay $45.

That’s a savings of $455 right off the bat! Over time and multiple transactions, these savings can really start to add up.

How Lower Fees Can Save You Money Long-Term

Beyond just saving you money on individual transactions, lower fees also mean that your overall financial situation is less likely to suffer in the long run. By paying less in transaction costs and other hidden fees associated with international transfers over time, you’ll be able to keep more of your hard-earned money where it belongs: in your pocket!

Furthermore, choosing a low-cost provider like CurrencyFair means that you won’t be subject to as many exchange rate markups as you would be with traditional banks or other providers. This is because their exchange rates are often inflated so they can make extra profit off of unsuspecting customers.

With CurrencyFair’s transparent exchange rates and low costs across the board, you can be sure that you’re getting the most value for your money every time. In short: choosing a provider like CurrencyFair with lower fees ensures that more of your money is going where it’s supposed to, and less is being lost to unnecessary fees and charges.

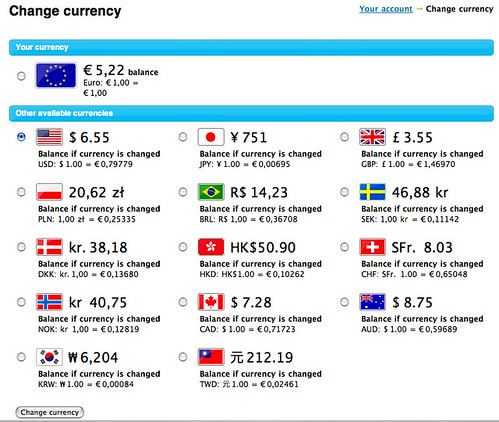

Competitive Exchange Rates

When it comes to overseas transfers, exchange rates can make a big difference in the amount of money that ends up in your recipient’s account. This is where CurrencyFair excels.

They offer some of the most competitive exchange rates on the market, which can translate into significant savings for users. So how does CurrencyFair manage to offer such competitive rates?

It all comes down to their unique P2P (peer-to-peer) model. Rather than relying on traditional banks to set exchange rates, CurrencyFair matches users who want to buy and sell different currencies directly with each other.

This allows them to offer rates that are often much better than what you would get from a bank. For example, say you needed to transfer €1,000 from your Euro account to someone’s US Dollar account.

If you were using a bank with a rate of 1 EUR = 1.20 USD, you would end up with $1,200 in your recipient’s account. However, if you were using CurrencyFair and found a match with someone who was willing to give you a rate of 1 EUR = 1.25 USD, you would end up with $1,250 – an extra $50 in your recipient’s account just for using CurrencyFair!

Saving Money When Making Overseas Transfers

The benefits of competitive exchange rates offered by CurrencyFair go beyond just getting more money into your recipient’s account – they can also save you money in the long run when making overseas transfers. If you’re transferring larger amounts – say €10,000 or more – even small differences in exchange rates can add up quickly.

For instance, let’s say that the difference between a bank and CurrencyFair was only 0.02 cents per euro exchanged per transaction (which is often much larger when comparing banks to CurrencyFair). This might not seem like a big difference, but it would translate into an extra €200 for every €10,000 transferred – over the course of multiple transactions this savings can add up to thousands of dollars or euros.

By offering competitive exchange rates, CurrencyFair not only puts more money in your recipient’s account, but also keeps more money in your own pocket. So if you’re looking to save some serious cash on your overseas transfers, CurrencyFair is definitely worth considering.

Fast Transfers: Get Your Money Across the World in a Flash

One of the primary advantages of using CurrencyFair for your international transfers is fast transfer times. Unlike traditional banks, which can take several days or even weeks to transfer funds across borders, CurrencyFair makes it possible to send and receive money within hours.

This can be particularly beneficial for urgent transactions, such as paying for emergency medical care or booking a last-minute flight. But how does CurrencyFair manage to make transfers so fast?

The answer lies in their innovative peer-to-peer platform. When you initiate a transaction on CurrencyFair, they match you with other users who are looking to exchange currencies at a similar rate.

By cutting out the middleman (i.e., traditional banks), they’re able to process transactions more quickly and efficiently. Of course, transfer times will vary depending on factors such as time of day and the currencies being exchanged.

However, in most cases, you can expect your funds to reach their destination within 1-2 business days. Plus, with CurrencyFair’s real-time tracking feature, you’ll always know exactly where your money is every step of the way.

The Benefits of Fast Transfers

It’s not just about convenience – there are also some tangible benefits to using a service like CurrencyFair for your international transfers when speed is important: – Avoid late fees: Whether you’re paying an invoice or settling an urgent debt, waiting too long could result in costly late fees that add up over time. – Take advantage of exchange rate fluctuations: In today’s fast-paced world economy, currency values can shift rapidly from day-to-day (or even hour-to-hour).

By making faster transfers via CurrencyFair, you may be able to take advantage of more favorable exchange rates before they disappear. – Stay ahead of potential economic turmoil: If you have reason to believe that an economic crisis is imminent in your recipient’s country, getting your money there quickly could help safeguard it against any potential instability or devaluation of local currency.

At the end of the day, when it comes to international transfers, time is money. By choosing CurrencyFair for your fast transfer needs, you can enjoy the peace of mind that comes with knowing your funds will arrive as quickly as possible.

Secure Transactions

The Importance of Security in International Transfers

When it comes to making international transfers, security is crucial. The last thing anyone wants is for their hard-earned money to fall into the wrong hands. That’s why CurrencyFair takes security very seriously.

They have implemented various measures to ensure that all transactions are safe and secure. One of the most important security measures taken by CurrencyFair is two-factor authentication (2FA).

This adds an extra layer of security to user accounts by requiring a unique code, sent via text or email, in addition to a password. This helps prevent unauthorized access to accounts and reduces the risk of fraud.

Another way CurrencyFair ensures secure transactions is through encryption. All information entered on their website is encrypted using SSL (Secure Sockets Layer) technology, which means that any data transmitted between users and CurrencyFair’s servers cannot be intercepted or read by third parties.

How CurrencyFair Protects User Information

In addition to securing transactions, CurrencyFair also takes steps to protect user information. They understand that privacy is a top concern for users, especially when it comes to financial information. To protect user data, CurrencyFair uses advanced firewalls and intrusion detection systems.

These technologies monitor all incoming traffic to their servers and block any suspicious activity before it can cause harm. They also undergo regular third-party audits and penetration testing to ensure that their systems are secure and up-to-date with the latest security standards.

Overall, CurrencyFair’s commitment to security sets them apart from other platforms offering international transfers. Users can feel confident knowing that their money and personal information are safe while using this service.

User-Friendly Platform

The Easy Option

One of the biggest advantages of using CurrencyFair for overseas transfers is the platform’s user-friendliness. The platform’s interface is designed to make the transfer process as simple and straightforward as possible.

This is especially useful for those who are new to international transfers and may be intimidated by the complexity of traditional banking systems. CurrencyFair’s platform offers a step-by-step guide through each stage of the transfer process, making it easy to follow and understand.

Users can easily view their balance, transfer history, and pending transactions from a single dashboard. The platform also features an intuitive search function that allows users to find specific transactions quickly.

Reducing Stress

Making an overseas transfer can be stressful, but using CurrencyFair’s user-friendly platform makes it much less daunting. The simplified interface helps to reduce stress levels by providing clear instructions at every stage of the process. Users no longer have to navigate through complex banking systems or deal with confusing jargon.

The platform also offers users a range of tools that can help them manage their transfers more effectively, such as exchange rate alerts and automatic recurring payments. These functions further reduce stress levels by automating certain aspects of the transfer process while keeping users informed at all times.

Increased Confidence

Using a user-friendly platform like CurrencyFair can increase confidence levels when making overseas transfers. By simplifying the process, users feel more in control and less likely to make mistakes or encounter unexpected issues. This increased level of confidence also makes it easier for users to seek assistance if they do encounter any problems along the way.

Furthermore, CurrencyFair provides extensive support throughout every stage of the transfer process via email, phone, or live chat with customer service agents available 24/7. This support helps build trust between users and CurrencyFair, leading to increased confidence in both the platform and the transfers made through it.

Customer Support: Our Priority

CurrencyFair’s customer support is top-notch. The company understands that dealing with international transactions can be stressful, and customer support plays a vital role in making the process seamless.

CurrencyFair offers various avenues for customers to reach out for assistance, including email, live chat, and phone calls. One of the standout features of CurrencyFair’s customer support is its response time.

The company prides itself on responding to inquiries within a few hours at most. This quick response time can be crucial when dealing with urgent transactions or when a customer needs assistance with a problem quickly.

Expert Assistance

CurrencyFair’s customer support team comprises experts who understand the ins and outs of international transactions. They are knowledgeable and experienced professionals who can help customers navigate the process smoothly. They provide expert advice on topics such as exchange rates, transaction limits, and transfer times.

Moreover, CurrencyFair’s team members are friendly and approachable individuals who genuinely care about their customers’ needs. They take the time to listen to their customers’ concerns and provide clear and concise solutions that work best for them.

24/7 Availability

Another aspect that sets CurrencyFair apart from traditional banks is its 24/7 availability for assistance. Customers can reach out anytime they need help or have questions about their transfers’ status or any other issues they may encounter during the process.

The importance of reliable customer support cannot be overstated when it comes to international transfers. There is nothing more frustrating than having an urgent transaction put on hold because of a technical issue or lack of proper guidance from your bank’s customer service representative.

CurrencyFair’s quality customer support is one reason why it pays off to use this platform for overseas transfers. Their team members expertise coupled with their responsiveness ensures that each client receives excellent treatment whenever they reach out for assistance during any stage of the transaction.

Conclusion

Overall, CurrencyFair offers a myriad of benefits for those who need to make overseas transfers. The low fees and competitive exchange rates are two standout features that can save users money in the long run. Additionally, the fast transfer times and secure transactions help make the process of sending money across borders less daunting.

Another important aspect to note is CurrencyFair’s user-friendly platform, which allows even those who may not be tech-savvy to easily navigate the website and transfer funds without much hassle. And if any issues do arise, customers can count on reliable customer support from CurrencyFair.

If you’re someone who frequently makes overseas transfers or is planning on doing so in the near future, I highly recommend using CurrencyFair. Not only will you save money compared to traditional banks, but you’ll also have peace of mind knowing that your transactions are secure and efficient.