Is Remitly And WorldRemit The Same?

Discover the differences and similarities between Remitly and WorldRemit, two popular digital money transfer services. Read our detailed comparison now.

The Basics: Remitly and WorldRemit

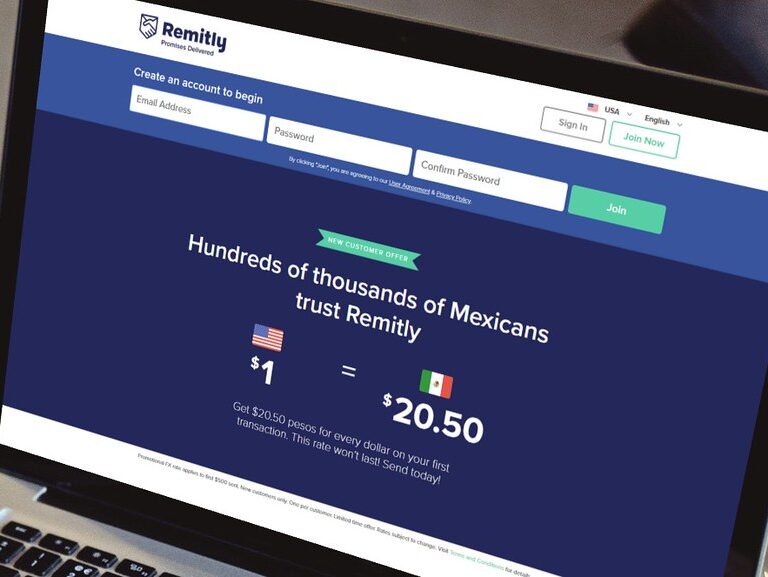

When it comes to sending money internationally, there are many options available, but two of the most popular services are Remitly and WorldRemit. Remitly is a digital-only platform founded in 2011 that allows users to send money from the United States, Canada, and the United Kingdom to over 50 countries worldwide.

WorldRemit was founded in 2010 and offers similar services globally, operating in over 150 countries around the world. Both platforms allow users to send money online or through their mobile app, making it easy for people on-the-go to quickly send funds back home.

The Purpose of This Article

The purpose of this article is to compare and contrast these two popular international money transfer services – Remitly and WorldRemit. We’ll explore how each service works, what sets them apart from one another, as well as highlight any similarities between them. Whether you’re an immigrant looking for a way to send money back home or a business owner needing to pay international vendors or employees quickly and efficiently, this article will help you decide which platform may be best suited for your needs.

Why Compare These Two Services?

Nowadays we have dozens of international transfer options available at our fingertips thanks to technology. However, with so many choices it can be difficult to know which option is right for you.

In order to make an informed decision about which platform is best suited for your needs you will need comprehensive information about each option available. That’s where we come in!

By providing detailed information about both services – including fees charged by each service provider, differences between target audiences served by both companies – we hope that you’ll gain insight into which one may be more suitable based on your individual needs. By the end of this article, you’ll have a comprehensive understanding of how these two platforms compare and which one you should use based on your specific situation.

Overview of Remitly and WorldRemit

Remitly and WorldRemit are two popular digital money transfer services that allow individuals to send money to friends, family, or businesses in other countries. Even though both services essentially provide the same service, there are still some important differences between them. Understanding these differences is crucial for those who want to make an informed decision about which service to use.

General Information About Each Service

Founded in 2011, Remitly is a digital remittance company based in Seattle, Washington. The company operates in over 20 countries worldwide and mainly targets immigrants living in the United States who want to send money back home. In contrast, WorldRemit is a UK-based online money transfer company founded in 2010 that operates globally across more than 130 countries.

How Each Service Works

To use either Remitly or WorldRemit’s service, users must create an account on their website or mobile app and provide identification information before they can start sending money. Once their account is set up, users simply enter the recipient’s information along with the amount of money they wish to send. Payments can be made using a debit or credit card as well as via bank transfer.

Comparison of Fees and Exchange Rates

The fees charged by both Remitly and WorldRemmit vary depending on several factors such as the amount of money being sent, the country of origin and destination, and the payment method used. Generally speaking, fees tend to be lower when paying through bank transfers rather than using a debit or credit card.

In terms of exchange rates offered by each service provider, this can also vary depending on a range of factors such as market fluctuations and local regulations governing currency exchange rates. While both services offer competitive exchange rates compared to traditional banks, Remitly is generally known for offering a slightly better rate.

Overall, when it comes to comparing the fees and exchange rates of both services, it’s worth comparing the total cost of each transaction once fees and exchange rates are factored in. This will help you determine which service offers a better value for your individual needs.

Differences between Remitly and WorldRemit

Target audience: Remitly focuses on immigrants in the US, while WorldRemit serves customers globally

One of the main differences between Remitly and WorldRemit is their target audience. Remitly primarily caters to immigrants living in the United States who need to send money back home to their families.

The company understands that these individuals may have limited access to traditional financial services, so they aim to provide a simple and user-friendly digital platform for international transfers. On the other hand, WorldRemit serves a more global customer base.

They operate in over 150 countries and offer multiple ways for people to receive money, such as bank deposits, mobile wallets, and even cash pickup. While Remitly’s focus is on speed and convenience for a specific demographic, WorldRemit strives to be accessible to anyone who needs to send money internationally.

Transfer options: WorldRemit offers more ways to send money, such as cash pickup

When it comes to transfer options, WorldRemit has a clear advantage over Remitly. While both services allow users to send money online or via an app, WorldRemit offers more ways for recipients to receive their funds. In addition to bank deposits and mobile wallets like many other providers offer, they also allow recipients in certain countries to pick up cash at designated locations.

This can be especially helpful for those without access or preference for traditional banking services. For example, if someone wants their family member in a rural area of a developing country with limited banking infrastructure or doesn’t have access yet could still safely pick up cash sent from abroad.

Speed of transfers: Remitly offers faster transfers for a higher fee

Another significant difference between Remitly and WorldRemmit is the speed of transfers. If you need to send money quickly, Remitly might be the better option. The company offers two different tiers of transfer speeds, with the more expensive option being significantly faster than the standard rate.

However, faster transfers come at a higher cost. Meanwhile, WorldRemit offers a variety of delivery options that allow customers to choose the speed that works best for them.

This means that while their fastest option may not be as quick as Remitly’s premium service, they still offer competitive delivery times at reasonable rates. Ultimately speed is determined by multiple factors like banks processing times and distance between origin and destination countries regardless which service one chooses.

Similarities between Remitly and WorldRemit

Digital-Only Services: Embracing the Future of Money Transfer

One of the main similarities between Remitly and WorldRemit is that both are digital-only services. This means that no physical location is required to send or receive money, making it a lot more convenient for customers.

This also means that transactions can be completed from anywhere in the world as long as there is an internet connection. Going digital has many advantages over traditional money transfer methods.

It allows for faster and more efficient transactions while reducing costs associated with brick-and-mortar locations. Additionally, it provides customers with greater control over their funds as they can track their transfers in real-time.

Competitive Exchange Rates: Get More Bang for Your Buck

Another similarity between Remitly and WorldRemit is that both offer competitive exchange rates compared to traditional banks. This means that customers can get more value for their money when transferring funds overseas. With exchange rates constantly fluctuating, getting the best deal can be a daunting task.

However, Remitly and WorldRemit take care of this by providing transparent rates with no hidden fees or markups. Customers can easily compare these rates before completing a transaction to ensure they are getting the best deal possible.

Security and Support: Your Money Is Safe With Us

Both Remitly and WorldRemit prioritize security and customer support. They understand the importance of keeping their customers’ information safe from fraudsters, hackers, or any other malicious intent. To achieve this goal, both platforms employ advanced encryption technologies to protect sensitive data like bank details or personal information during transfers.

Additionally, they have customer support teams available 24/7 to assist you in case you have any issues while using their services. There are several similarities between Remitly and WorldRemit.

Both are digital-only services, offer competitive exchange rates compared to traditional banks, and prioritize security and customer support. By providing these services, both platforms have managed to revolutionize the money transfer industry by making it easier, faster, and safer for people to send money around the world.

Small Details That Set Them Apart

When it comes to sending money overseas, every little detail counts. Remitly and WorldRemit may seem very similar at first glance, but there are some small differences between the two that could make a big difference to you. Here are a few things to keep in mind.

One of the biggest differences between Remitly and WorldRemit is their user interfaces. While both services have easy-to-use apps and websites, they have different designs and features that could affect your experience.

For example, Remitly’s app has a simpler layout with larger buttons, making it easier to use for people who might not be as tech-savvy. On the other hand, WorldRemit’s app has more features like notifications for when your transfer is complete or when exchange rates change.

Another thing to consider is customer reviews. While both companies have high ratings on Trustpilot and other review sites, there are some small differences in what people say about each service.

Some customers prefer Remitly because of its fast transfer times or low fees, while others like WorldRemit’s wider range of options for receiving money (such as cash pickup). Reading through reviews can give you a good idea of what each service does well and where it might fall short.

Accessibility is another key factor to consider when choosing between Remitly and WorldRemit. While both services operate in many countries around the world, they may not be available everywhere you need them to be.

For example, if you’re looking to send money from certain countries in Africa or Asia, you may find that one service has more options than the other. It’s always worth checking ahead of time to make sure you can use the service where you need it.

User Interface Differences

Both Remitly and WorldRemmit provide user-friendly interfaces which makes them stand out among other competitors in the market when it comes to sending money overseas. The user interface of Remitly is very simple and easy to use, making it accessible for people who are not very tech-savvy. The buttons are large and clear, and navigating through the app or website is pretty straightforward.

On the other hand, WorldRemit’s app has a sleeker design with more advanced features such as notifications for when your transfer is complete or exchange rate changes. It also allows users to save favorite recipients for quick access.

When comparing these two remittance services on their user interface experience, both of them have an intuitive design that makes it easy for users to navigate through the app or website without any difficulty. However, if you prefer a more advanced look with notifications as well as saving favorite recipients then WorldRemmit would be your go-to option.

Customer Reviews

When choosing between Remitly and WorldRemmit, customer reviews can provide valuable insights into each service’s strengths and weaknesses. Both services have high ratings on review sites such as Trustpilot but there are some differences in what people say about each service.

Remitly customers tend to appreciate its fast transfer times and low fees. A lot of people praise Remitly’s customer support team for being helpful in troubleshooting issues that may arise during transactions.

WorldRemit customers like its wider range of options for receiving money such as cash pick-up which makes it easier to receive funds quickly without having a bank account. It’s essential to read through customer reviews before deciding which service provider to use because they can give you an idea of what each service does well and where it might fall short.

Accessibility In Different Countries

One important factor that sets these two remittance services apart is their accessibility in different countries around the world. Both Remitly and WorldRemmit operate in many countries globally, but they may not be available everywhere you need them to be.

For instance, Remitly is specifically targeted at immigrants in the US, so their services may not be accessible in other countries. On the other hand, WorldRemmit serves customers globally and has a wider range of options for receiving money such as cash pick-up which makes it more accessible.

It’s always essential to check before selecting a remittance service provider to see if they operate in the country you want to send money to or from. This will save you time and hassle by selecting providers that are available where you need them most.

Conclusion

Recap of similarities and differences between Remitly and WorldRemit

While Remitly and WorldRemit have a lot of similarities in terms of their digital-only platforms, competitive exchange rates, and commitment to security and customer support, there are also some key differences between the two services. Remitly is more targeted towards immigrants in the US and offers faster transfers for a higher fee, whereas WorldRemit serves customers globally and has more options for sending money (e.g., cash pickup).

However, regardless of which service you choose to use, it’s important to keep in mind that fees and exchange rates can vary depending on factors such as the destination country, transfer amount, and payment method. As such, it’s always a good idea to compare multiple services before making a decision.

Personal recommendation based on individual needs

When it comes down to choosing between Remitly vs. WorldRemit or any other digital remittance service for that matter, the decision ultimately depends on your individual needs. If you require fast transfers at a higher cost or if you are an immigrant living in the US looking for an easy way to send money back home with competitive rates then Remitly might be your best option.

On the other hand if you want more options when sending money (e.g., cash pickup) or if you require global coverage then WorldRemit is definitely worth considering. After testing both services ourselves we can recommend each one as top-notch options within this market but again it really depends on what you’re looking for in a remittance company.

It’s important to weigh all available options according your priorities so that you can make an informed decision suited specifically for your circumstances. In short: both companies are impressive alternatives that offer great value – just make sure you choose one that matches your specific needs and preferences.