2023 CurrencyFair Vs Wise: A Comprehensive Comparison Of Two Wise Ways To Transfer Money Abroad

Looking for a reliable, low-cost international money transfer service? Compare Wise and CurrencyFair in this detailed article by an expert writer.

The Battle of Money Transfers: Wise vs CurrencyFair

Introduction

International money transfers can be a bit of a headache. With so many options and fees to consider, it can be overwhelming to choose the best service for your needs.

Two popular options are Wise (formerly TransferWise) and CurrencyFair; both offer a convenient way to transfer funds internationally. In this article, we’ll take a closer look at these services and see how they stack up against each other.

Brief Overview of Wise and CurrencyFair

Wise is an online money transfer service that was founded in 2011 with the goal of making international money transfers fast, cheap, and transparent. It operates on a peer-to-peer model where users send money directly to one another using real exchange rates to avoid hidden fees associated with traditional bank transfers.

CurrencyFair was also founded in 2011 and operates on a marketplace model where users trade currencies with each other at competitive exchange rates. The company aims to offer better exchange rates than banks while still maintaining low fees.

Importance of International Money Transfers

International money transfers have become increasingly important in our global economy. Whether you’re sending funds abroad for business or personal reasons, having access to reliable and affordable services is crucial. Traditional banking methods like wire transfers can be slow and expensive due to high fees and unfavorable exchange rates, making them less than ideal for international transactions.

That’s where services like Wise and CurrencyFair come in – they offer an alternative that is faster, cheaper, more transparent, and often more convenient than traditional banking methods. By using these services, you can send funds abroad without worrying about hidden fees or unfavorable exchange rates, allowing you to get the most out of your hard-earned money.

Wise (formerly TransferWise)

History and Background

Founded in 2011 by Estonian entrepreneurs Kristo Käärmann and Taavet Hinrikus, Wise was created with the mission to make international money transfers cheaper, faster, and more transparent. The idea came from Hinrikus’ personal experience of losing money on international transfers due to unfavorable exchange rates.

Initially named TransferWise, the company changed its name to Wise in February 2021 to reflect its expansion beyond just transferring money. With over 10 million users and more than £4.5 billion transferred every month, Wise has become one of the largest fintech companies in the world.

How it Works (Peer-to-Peer System)

Wise operates on a peer-to-peer system which means that when you transfer funds through their platform, your money is actually exchanged with someone else’s who needs the opposite currency. This system allows for real exchange rates without any hidden markups or fees.

For example, if you want to transfer USD to EUR, Wise will find someone who wants to transfer EUR to USD and swap your funds directly with theirs at the real exchange rate mid-market rate. This eliminates any need for a middleman bank or broker which ultimately reduces costs.

Features and Benefits (Low Fees, Real Exchange Rates, Multi-Currency Account)

One of the main advantages of using Wise is their low fees compared to traditional banks or brokers. Wise charges a small upfront fee plus a percentage based on the amount transferred which varies depending on the currency pair. Another benefit is that they offer real exchange rates without any hidden markups or fees which ensures that you get a fair deal every time.

Additionally, they offer multi-currency accounts that allow you to hold up to 54 currencies at once. This feature allows you to avoid currency conversion fees when you’re traveling or making international purchases online.

User Experience and Customer Reviews

Wise is known for its user-friendly interface, fast transfer times, and excellent customer service. Their mobile app is highly rated on both the App Store and Google Play with users praising its simplicity and ease of use.

Customer reviews are overwhelmingly positive with many praising the transparency of their fees and exchange rates. Many have also reported significant savings compared to using banks or other money transfer services.

CurrencyFair

History and Background

CurrencyFair was founded in 2009 by Brett Meyers and a group of other expats living in Ireland who were frustrated with the high fees and poor exchange rates offered by traditional banks. They realized that there had to be a better way to send money internationally, which led to the creation of CurrencyFair. Since then, the company has grown to over 100 employees and served over $10 billion worth of transactions.

How It Works (Marketplace System)

CurrencyFair operates on a peer-to-peer marketplace system, which means that users can both buy and sell currencies directly with each other. When you make a transfer, CurrencyFair matches you up with someone who wants to exchange their currency in the opposite direction. This means that you get access to more competitive exchange rates than you would receive from traditional banks or other money transfer services.

Features and Benefits (Low Fees, Competitive Exchange Rates, Ability to Set Own Rate)

One of CurrencyFair’s biggest advantages is its low fees. The company charges just 0.4% of the amount being transferred plus a small fixed fee for most transactions, which is significantly less than what many banks charge for international transfers.

In addition to low fees, CurrencyFair also offers highly competitive exchange rates. Because the service operates on a marketplace system, users can often get better rates than they would from other services or banks.

Another unique feature of CurrencyFair is its ability to set your own exchange rate. This allows users to potentially get an even better rate than what’s currently available on the platform by setting their own rate and waiting for someone else to match it.

User Experience and Customer Reviews

Many users report positive experiences with CurrencyFair’s user interface, calling it intuitive and easy-to-use. Users also appreciate how quickly transfers are processed, with many transactions being completed within 1-2 business days.

Overall, customers seem to be pleased with the low fees, competitive exchange rates, and overall ease of use that CurrencyFair offers. However, some users have reported issues with customer service or delays in receiving their funds.

Comparison between Wise and CurrencyFair

Fees Comparison

When it comes to fees, both Wise and CurrencyFair offer competitive rates compared to other traditional banks or money transfer services. Wise charges a small fee for its services, which is typically around 0.5% of the transfer amount.

CurrencyFair also charges a percentage-based fee on each transfer which is calculated based on the amount being transferred. It’s important to consider that both platforms may charge additional fees depending on the method of payment used for the transfer.

For example, if you use a credit card to fund your transfer through either platform, there may be additional fees associated with that payment method. However, in general, both Wise and CurrencyFair are cost-effective options for international money transfers.

Exchange Rates Comparison

When it comes to exchange rates, both Wise and CurrencyFair offer real-time mid-market exchange rates (the rate at which banks exchange currencies with each other), which are generally much more favorable than those offered by traditional banks or exchange bureaus. However, there may be slight differences in exchange rates offered by each platform due to their different models – peer-to-peer system (Wise) vs marketplace system (CurrencyFair).

In general, users can expect very competitive exchange rates from both platforms. It’s worth noting that while Wise offers real-time exchange rates for most currencies supported by its platform, some less common currencies may not be available or might have limited liquidity.

Speed of Transfer Comparison

Wise and CurrencyFair offer different speed options for international money transfers. With Wise’s “Fast” option (available only in certain markets), payments can be completed within seconds or minutes depending on recipient bank processing times; however standard delivery speeds take up to three business days depending on currency and destination country.

CurrencyFair offers two options: a standard delivery speed taking 1-2 business days, and a “FastTrack” option which is delivered within 0-2 business days. However, it’s worth noting that the FastTrack option usually comes with higher fees.

Ease of Use Comparison

Both Wise and CurrencyFair are user-friendly platforms with intuitive user interfaces. However, they have different setup processes due to their different models. Wise allows users to easily create an account and begin transacting within minutes thanks to its peer-to-peer system while CurrencyFair requires a little more effort since users need to set up a marketplace account first, which may take slightly longer.

Both platforms offer mobile applications for easy access on the go. Additionally, they both allow users to track their transfer progress in real-time via email and notifications.

Security Measures Comparison

Wise and CurrencyFair employ robust security measures to protect user data and transactions. Both platforms use two-factor authentication during login process in order ensure that only authorized individuals are accessing accounts.

They also employ encryption technology to secure all personal information, including bank account details. Both Wise and CurrencyFair are fully licensed by relevant financial authorities such as the Financial Conduct Authority (FCA) in the United Kingdom.

In addition, customer funds are held in segregated accounts for added protection. Overall, when it comes to security measures both Wise and CurrencyFair take user privacy very seriously ensuring peace of mind when it comes sending money abroad.

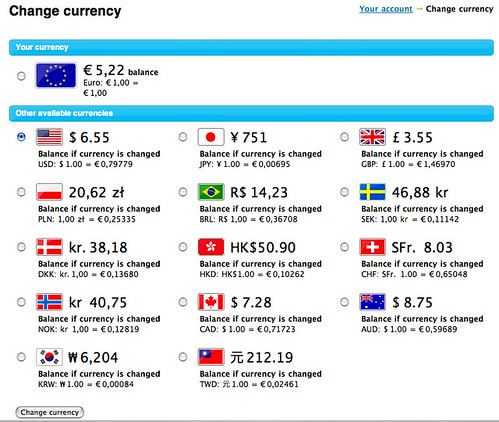

How to Open a Multi-Currency Account with Wise

Opening a multi-currency account with Wise is a breeze. First, head over to their website and sign up for an account. Once you’ve verified your identity, you’ll be able to access all the features of your account including the ability to send and receive money in over 50 currencies.

The great thing about having a multi-currency account with Wise is that you can hold multiple currencies at once without having to worry about conversion fees. You can also switch between accounts instantly, giving you ultimate flexibility when it comes to managing your finances.

When opening your wise multi-currency account, make sure to read through all the terms and conditions carefully so that you fully understand how everything works. Overall, opening a multi-currency account with Wise is a smart choice for anyone who frequently sends or receives money internationally.

The Difference Between a Borderless Account vs Regular Account with Wise

If you’re considering opening an account with Wise, it’s important to understand the difference between their borderless account and regular account options. A borderless account from Wise is essentially an all-in-one solution for managing your international finances.

With this type of account, you can hold multiple currencies at once, as well as receive payments in different currencies without any fees. You’ll also get access to other features like debit card payments and ATM withdrawals.

In contrast, a regular wise account only allows you to make currency exchanges from one currency into another – there are no additional features like debit cards or ATM withdrawals included. If you only need basic currency exchange capabilities, then this might be the right choice for you.

How To Set Your Own Exchange Rate on CurrencyFair

CurrencyFair offers users the unique ability to set their own exchange rate when making transfers. This is an incredible feature that can save you a lot of money over time.

To set your own exchange rate, simply log into your account on the CurrencyFair website and follow these steps:

- Click on the “Exchange” tab

- Select the currency you wish to exchange

- Enter your desired rate (this could be higher or lower than the current mid-market rate)

- CurrencyFair will automatically match you with another user willing to make the exchange at your desired rate

This feature is perfect for those who want more control over their money and don’t want to rely solely on market rates. Keep in mind, however, that setting your own rate may take longer to find a matching partner than just accepting the current market rates.

The Benefits of Using the Auto Transaction Feature on CurrencyFair

If you frequently make international money transfers, then CurrencyFair’s auto transaction feature is a game-changer. This feature allows you to set up recurring transfers at regular intervals automatically.

For example, if you need to send $1,000 USD to someone every month, you can set up an auto transaction so that it happens automatically without having to manually transfer funds each month. This not only saves time but also ensures that payments are always made on time without any chance of forgetting to initiate a transfer.

The auto transaction feature also locks in rates ahead of time, which means you won’t be affected by market fluctuations between transactions. Overall, this feature is incredibly convenient and can save frequent users a lot of time and hassle.

Conclusion

Both Wise and CurrencyFair offer excellent options for international money transfers. Both platforms have their unique features and benefits that set them apart from each other. While Wise is a peer-to-peer system, CurrencyFair operates like a marketplace.

Both platforms offer competitive exchange rates, low fees, and fast transfer times. If you are looking for a platform with an excellent user experience and ease of use, Wise could be the right choice for you.

Its borderless account feature also makes it easy to manage money in multiple currencies. However, if you want more control over your exchange rate and want to set your own rate, CurrencyFair could be the best option for you.

The Auto Transaction feature also offers convenience for those who want maximum automation.

If setting your own exchange rate is important to you or if you need maximum automation with Auto Transaction feature then go with CurrencyFair. Regardless of which platform you choose, international money transfers will no longer be a costly headache with either of these options at hand!