CurrencyFair vs. Revolut Review 2023: The Ultimate Battle for Your Money Transfers

Choosing between CurrencyFair and Revolut for money transfers? Our comprehensive guide compares their features, fees, and security to help you decide.

Introduction

Money transfer services are a critical part of the global economy, helping people send payments and conduct transactions across borders with ease. With the rise of technology, there are now several digital platforms that offer money transfer services.

However, with so many options to choose from, it can be challenging for users to determine which provider is best suited for their needs. The importance of choosing the right money transfer provider cannot be overstated.

Opting for an unreliable or insecure platform can result in delays, lost funds, and financial stress. It is vital to select a service that prioritizes security and provides competitive exchange rates and fees to ensure smooth transactions every time.

Overview of CurrencyFair and Revolut

CurrencyFair and Revolut are two popular digital platforms that offer money transfer services to individuals worldwide. CurrencyFair was founded in 2009 by Brett Meyers and Jonathan Potter to provide a cheaper alternative to traditional banks when sending money abroad. CurrencyFair allows users to exchange currencies at market-beating rates while also offering quick transfers with no hidden costs or fees.

Revolut, on the other hand, was launched in 2015 by Nikolay Storonsky and Vlad Yatsenko. Initially designed as a prepaid debit card linked with an app that allows users to spend money abroad without any hidden fees or exchange rates at interbank rates; it has now evolved into one of the most popular digital banking platforms globally.

Revolut offers its customers multiple features such as budgeting tools, crypto trading options besides their core product – international money transfers without any markups on exchange rates at lightning-fast speeds. In this article, we’ll take an in-depth look at these two leading platforms: CurrencyFair vs Revolut- highlighting their key features such as exchange rates & fees, transfer speed & options along with security measures, and the pros and cons of using each platform to help you make an informed decision while choosing the right money transfer provider that suits your specific needs.

CurrencyFair

Overview of CurrencyFair’s Services and Features

CurrencyFair is a peer-to-peer currency exchange platform that allows individuals and businesses to send money internationally at a fraction of the cost charged by traditional banks. The company was founded in Ireland in 2009 and has since expanded to serve customers in over 150 countries worldwide, processing more than $10 billion in transactions.

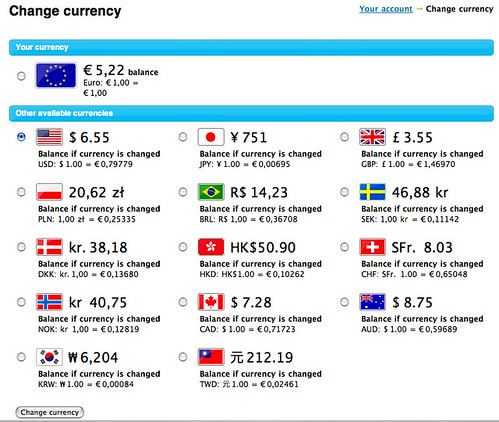

CurrencyFair offers several services and features for customers, including the ability to buy and sell currencies at competitive rates, make international transfers quickly, set up recurring payments, and track transactions online. Customers can also use the platform to manage their account settings, view transaction histories, and access customer support.

Exchange Rates and Fees

One of the main advantages of using CurrencyFair is its low exchange rates compared to traditional banks or other money transfer providers. The platform uses an innovative peer-to-peer model that matches buyers with sellers in order to provide close-to-market exchange rates.

In terms of fees, CurrencyFair charges a flat rate of €3 ($3.50) per transfer plus a percentage fee based on the amount transferred. However, this fee can be reduced significantly if customers choose to use the platform’s “Auto-Transaction” feature or if they refer friends who sign up for an account.

Transfer Speed and Options

CurrencyFair offers different transfer options depending on the destination country. In general, transfers made within Europe are processed within one business day while transfers outside Europe can take up to three business days.

Customers have several options when it comes to making transfers through CurrencyFair. They can choose between bank transfers or credit/debit card payments (depending on their location), set up recurring payments for bills or other expenses, or schedule future payments up to six months in advance.

Security Measures

Security is a top priority for CurrencyFair, and the company takes several measures to protect customers’ personal information and transactions. The platform uses 256-bit SSL encryption to secure all data transfers, and customer funds are held in segregated accounts with top-tier banks. In addition, CurrencyFair is regulated by the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC), which provides additional oversight and ensures that customer funds are kept safe.

Pros and Cons of Using CurrencyFair Advantages:

- Low exchange rates: currencyfair offers some of the best exchange rates on the market thanks to its peer-to-peer model.

- Fast transfer times: transfers made within europe typically take only one business day, while transfers outside europe take up to three days.

- High level of security: customer funds are held in segregated accounts with top-tier banks, and all data transfers are encrypted using 256-bit ssl encryption.Disadvantages:

- Limited currency options: while currencyfair supports over 20 currencies, it may not be the best option for customers looking to transfer less-common currencies.

- No physical locations: unlike traditional banks or other money transfer providers, currencyfair does not have physical locations where customers can speak with representatives face-to-face.

Overall, CurrencyFair is a great option for customers who value low exchange rates, fast transfer times, and a high level of security. While it may not be the best choice for customers who need to transfer less-common currencies or prefer in-person customer service options, those who prioritize cost-effectiveness will likely find it to be an excellent provider.

RevolutOverview of Revolut’s services and features

Revolut is a UK-based digital banking platform that offers customers a range of financial services. Founded in 2015, the company initially started off as a mobile app that allowed users to easily send and receive money across borders, but has since expanded its offerings to include insurance, cryptocurrency trading, and stock trading. Exchange rates and fees

One of the most attractive features of Revolut is its competitive exchange rates. The company uses interbank exchange rates for currency conversion, which means that customers can typically save money compared to traditional banks or other money transfer providers. Additionally, Revolut charges no hidden fees on transactions, making it a transparent choice for people who want to know exactly how much they’re spending. Transfer speed and options

Revolut offers fast transfer speeds for both domestic and international transfers. Domestic transfers are usually completed within seconds, while international transfers can take up to two business days depending on the recipient bank’s processing times. Customers can also choose between standard or priority transfer options depending on their needs. Security measures

Revolut takes security seriously and has implemented multiple measures to protect customers’ accounts and transactions. These include two-factor authentication, biometric login options like Face ID or Touch ID, transaction notifications in real-time via the mobile app or email alerts, as well as 24/7 customer support. Pros and cons of using Revolut

There are several advantages to using Revolut for your money transfer needs: Advantages:

- A wide range of currencies supported: With over 150 currencies available on the platform (including cryptocurrencies), customers can easily manage their finances across borders.

- A physical debit card available: Customers can use their Revolut card to make purchases anywhere that accepts Mastercard or Visa.

- User-friendly app interface: The mobile app is intuitive and easy to navigate, making it simple for customers to manage their finances on-the-go.

However, there are also some limitations to Revolut’s services that customers should be aware of: Disadvantages:

- Limited customer support: Although Revolut offers 24/7 customer support via in-app chat or phone, there have been complaints from some users about long wait times or unresponsive support staff.

- Limited transfer limits: Depending on the user’s account level, there may be limits on how much they can transfer per month without incurring fees.

Overall, Revolut can be a great choice for people who frequently travel abroad or need to send money internationally. Its competitive exchange rates and wide range of currencies supported make it an attractive option for those looking for a transparent and user-friendly money transfer provider.

Comparison between CurrencyFair vs Revolut

The exchange rates and fees

When it comes to exchange rates and fees, both CurrencyFair and Revolut are very competitive. CurrencyFair charges a fee of 0.25% to 0.45% of the amount transferred, while Revolut offers fee-free transfers up to a certain limit (depending on the account type) and then charges 0.5% on the amount transferred above that limit. However, it is important to note that while Revolut’s exchange rates may seem better at first glance, they actually include a markup of up to 2% for weekends, which can significantly affect your transfer costs.

Transfer speed and options

Both CurrencyFair and Revolut offer fast transfer times, with transfers typically taking no more than one business day. However, as mentioned earlier in this article, CurrencyFair offers more options when it comes to transfer speed – you can choose between their “Standard Transfer” (which takes around two business days), or their “Express Transfer” (which usually takes just one business day). In contrast, Revolut only offers one transfer speed – standard.

Security measures

When it comes to security measures, both CurrencyFair and Revolut take extensive precautions to ensure their customers’ safety. Both providers are regulated by the Financial Conduct Authority (FCA) in the UK and hold e-money licenses.

Additionally, they use SSL encryption technology for all online transactions and have two-factor authentication available for added security. The main difference between them is that CurrencyFair stores customers’ funds in segregated accounts with tier-1 banks such as Wells Fargo or Barclays Bank PLC., while Revolut uses its own banking license in Lithuania.

Conclusion

Choosing between CurrencyFair vs. Revolut ultimately depends on your specific needs and preferences. CurrencyFair may be the better choice if you are looking for a provider with a wider range of currency options and more transfer speed options.

On the other hand, Revolut may suit your needs better if you prefer a user-friendly app interface, physical debit card availability, and fee-free transfers up to a certain limit. Regardless of which provider you choose, rest assured that both CurrencyFair and Revolut are secure and reliable options for your money transfer needs.