A Guide to Using the CurrencyFair Online Exchange and Transfer Platform in 2023

CurrencyFair is a marketplace for buying and selling foreign currency online. It is one of the most widely used methods of sending low sums of money abroad because there is no minimum transfer amount and the exchange rate is favorable.

CurrencyFair is a convenient option for making wire transfers of any size.

How to use Currencyfair and how Currencyfair works?

I have compiled a detailed Currencyfair review and current guide on how to register and send money using the CurrencyFair exchange/transfer platform.

This comprehensive guide includes information on the wide range of supported currencies, maximum transfer amount, expected delivery time, and various transfer options. It also covers costs, accepted payment methods, shipping details, and more.

Come to GET if you have friends that need to send money overseas.

What is currencyfair?

Address of the website:

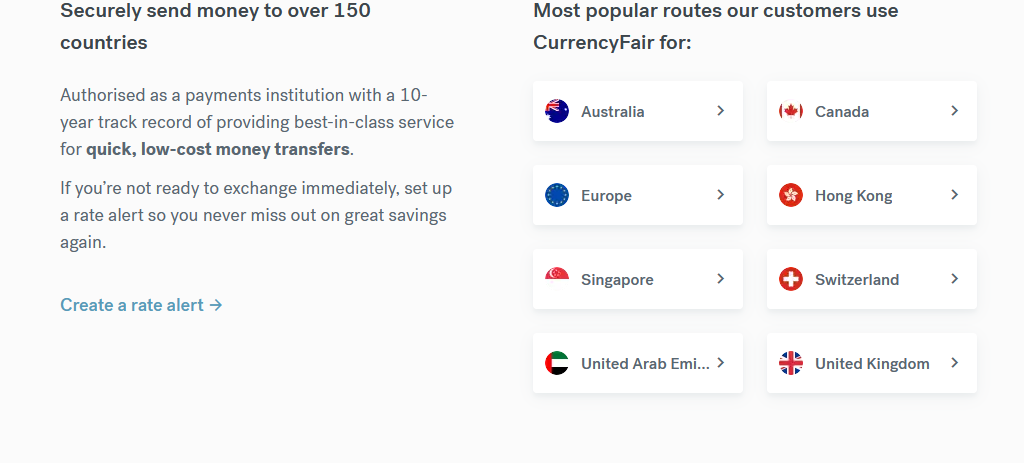

CurrencyFair, founded in Ireland in 2010, is an internet platform for international money transfers and currency conversion.

The business has helped over 150,000 customers over the past decade.

CurrencyFair has revolutionized the way that foreign exchange is conducted on the Internet, iOS, and Android with its groundbreaking P2P architecture and secure cutting-edge technology.

Currently, the company operates out of a number of different locations across Asia, Europe, the Middle East, and the United States, including Ireland, the United Kingdom, Singapore, Hong Kong, and Australia.

CurrencyFair pairs users from different countries and facilitates currency conversion operations, with users paying a minor exchange rate difference and a flat remittance cost.

CurrencyFair allows its customers to store 17 different currencies, transfer funds in advance to the account, select their preferred exchange rate, wait in line for matching by the system, and then either store the newly acquired currency or send it out immediately.

principle of operation

In 2010, CurrencyFair was the first P2P (peer to peer) currency exchange platform. To facilitate the exchange of funds in both directions, peer-to-peer markets provide a matching function.

The key to their success is that the money never leaves the country, so there are no foreign currencyfair exchange fees to worry about.

You can use CurrencyFair to buy or sell currency by sending funds to one of their local bank accounts in a variety of different countries.

CurrencyFair connects those looking to purchase or sell foreign currency with those looking to buy or sell currency, and if a match is not discovered, consumers are given the option of using the best exchange rate available at the time of transfer.

Pros and Cons of CurrencyFair

CurrencyFair is an excellent choice for most foreign exchange transactions. Here are some of the advantages and disadvantages of using this system.

Pros

- Get paid from abroad without breaking the bank

- Sending money abroad has no minimum and a very high cap.

- To over 150 different countries we can ship to!

- Option to delay payment for a better currency rate or set up automatic payments from a local Singaporean office

- They take the safety of your money, personal information, and website very seriously.

- Accessible and helpful client service

- Supplier and business payments for international commercial invoicing

- Headquarters in Dublin and London as well as Sydney, Melbourne, Hong Kong, and Singapore

Cons

- Without funds in your CurrencyFair account, you will not be able to lock in the exchange rate.

- Payment methods like cash on delivery, mobile wallets, and bill pay are not offered.

- Waiting for a rate match could be necessary if you want to get the best possible exchange rate.

- Transferring money across borders can take longer than with some banks.

- If a consumer needs to send a specific amount before knowing the exchange rate, this may not be the best option.

Currency backing

CurrencyFair accepts deposits in 17 different currencies:

AED, AUD, EUR, GBP, CAD, CHF, CZK, DKK, HKD, HUF, NOK, NZD, PLN, SEK, SGD, USD, ZAR

CurrencyFair works with 22 different remittance currencies, including:

AED, AUD, EUR,GBP, CAD, CHF, CZK, DKK, HKD, HUF, NOK , NZD, PLN, SEK, SGD, USD, ZAR, IDR, ILS, INR, PHP, THB

In addition to the more popular Australian dollars, Canadian dollars, Euros, British Pounds, Thai Baht, and US Dollars, CurrencyFair currently offers the remittance of 22 different currencies.

Payment and Collection Options

Different Payment Methods Available CurrencyFair accepts bank transfers as a form of payment. Debit cards are accepted methods of payment in Ireland, while EFT and BPay are accepted in Australia.

Strategies for Collecting

Only international bank accounts can receive transfers through CurrencyFair. Withdrawing cash or sending money to a mobile wallet is not an option.

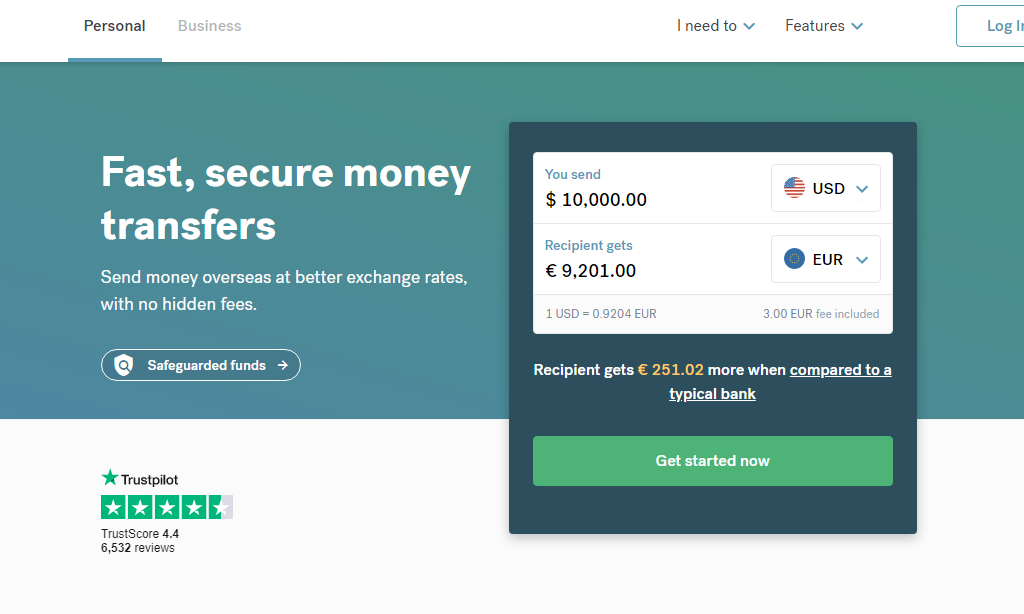

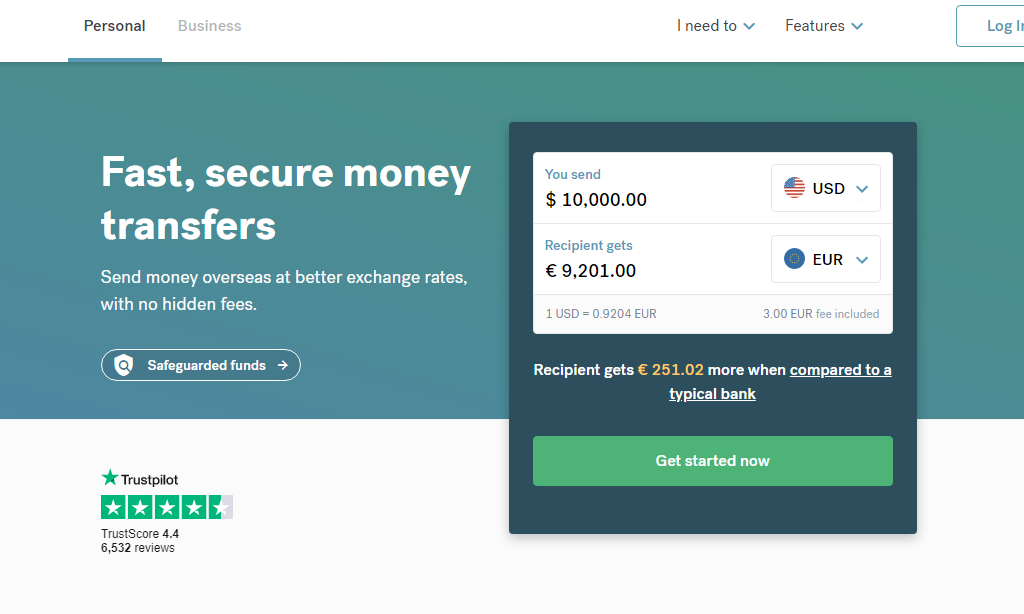

Exchange Rates and Fees

CurrencyFair exchange rates and transfer fees are among the lowest in the business. Your transfer information, including the fees and exchange rate pricing for your currency combination, are always visible in the real-time calculator.

Exchange rate

For example:

| Transfer $100 to | Live Exchange Rate (XE) | CurrencyFair rate 0.6127 | Difference | %Markup |

|---|---|---|---|---|

| Australian dollar (AUD) | 144.93 | 144.16 | 0.77 | 0.5313 |

| British pound (GBP) | 76.54 | 76.15 | 0.39 | 0.5095 |

| United Arab Emirates (AED) | 367.25 | 365.00 | 2.25 | 0.6127 |

The accompanying table shows that CurrencyFair is a cheap way to convert currencies because the %Markup is low.

Commission for handling

After the initial free transfer period ends, new users will be charged a nominal set price of 3 EUR (or the currency equivalent) each transfer. On its website, CurrencyFair specifies that its average transfer charge is 0.45%.

Cost overruns

If you make a transfer with a credit card, the card issuer may tack on a cash advance fee to the transfer fee and exchange rate markup. CurrencyFair is a major benefit, especially for large transfers, because banks add a markup of 4-6% to the exchange rate and charge transfer costs of up to $40.

Quota

CurrencyFair allows money transfers in any quantity, with a minimum of 8 Euros (or its equivalent) and no limit. To transfer money internationally with some companies, a minimum of $1,000 may be required. CurrencyFair could be a decent choice if you need to make a few minor transfers.

Time of Arrival

Depending on the type of money exchanged, it can take anywhere from zero to three business days.

Information required for remittance

- Payee name

- Bank account number and country where the account is located

- Purpose of remittance

How to Set Up Currencyfair?

1.Sign up for an account on CurrencyFair.com

Sign up now for no cost – It takes very little time and effort to create an account. Your free or paid account can be activated in about five minutes.

2.Verification of Account

A government-issued photo ID, passport, or valid driver’s license will suffice. You’ll also need to use the webcam on your smartphone to upload or scan the first and second pieces of proof of address:

- Electricity Bill

- Receipt from a financial institution

- disclosure of earnings

- notice of the local government

- Proof of Vehicle Registration

- rental contract or lease

- Notice of Homeowners Insurance / Renewal

3.Waiting for CurrencyFair to review identity

It may take one business day to review your identity.

4.Insert a new payee or remittance order straight

Simply plug in your intended transfer amount, the currencies involved, the delivery date, the exchange rate, and the transfer costs, and the calculator will provide you with an approximate amount the recipient will get.

5.Fill in the payee information

Provide the recipient’s details. The required information is:

- Account holder name

- The country where the account is located

- Account number

- Bank Code

- Payee Reference – the information you enter here will appear on your bank statement

- State the purpose of the transfer

You can check an email notification box if you want recipients to be notified of the transfer.

6.Verify Funds Transfer

In order to verify your identity before allowing you to make a transfer to CurrencyFair for transfer out to your beneficiary, you will be sent a code to your registered mobile phone or asked to answer the phone.

This is the transfer process of the web version, and the process of the mobile client is roughly similar.

Below is a helpful video that may assist you with the registration process for CurrencyFair.

When using CurrencyFair, can I revoke a transaction?

You have the option to revoke or change your transaction until it has been matched. To reverse a purchase, click on your account’s “Transaction Overview” page. However, once the transaction has been correctly matched, it cannot be undone.